Cover Story- Tariff Tantrums

Donald Trump’s aggressive tariff campaign, masked as economic patriotism, has wreaked havoc on global trade and U.S. markets alike. What began as a promise to protect American industries has spiraled into a self-inflicted economic crisis—disrupting supply chains, inflating prices, and alienating allies. As protectionist policies mount, the U.S. risks isolating itself in an increasingly interconnected world.

Donald Trump, the self-proclaimed master negotiator and champion of all things American, has once again decided to “shake things up” on the global stage, this time by unleashing a tariff blitzkrieg upon the world. Ostensibly designed to safeguard American industries from the ravages of unfair competition, this protectionist crusade feels less like a calculated strategy and more like a toddler throwing a tantrum in a global trade sandbox, flinging sand (in this case, tariffs) at anyone who dares to build a sandcastle higher than his. The result? Fractured supply chains, fueled inflation, and an increasingly isolated America, left to sulk in the corner with its protectionist toys while the rest of the world tries to clean up the mess.

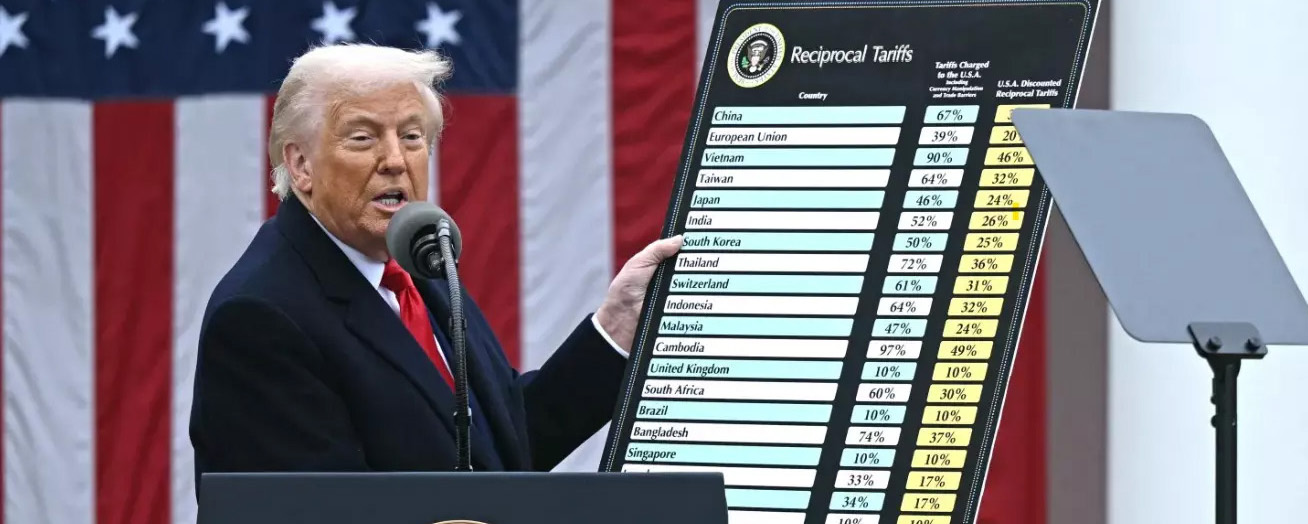

The initial promise of tariffs is always enticing: a gleaming shield protecting domestic industries from the “onslaught” of foreign competition, allowing them to thrive and create jobs. In practice, however, tariffs have a nasty habit of acting more like boomerangs, whacking the thrower squarely in the face. U.S. firms, suppliers, and ultimately, the long-suffering consumers, bear the brunt of these policies through higher input costs, disrupted operations, and a general sense of economic unease. As a dryly academic Wharton School analysis points out, Trump’s tariff regime—ranging from a somewhat comical 10% to a positively ludicrous 60% on targeted countries—functions as a hidden tax, slowing GDP growth and reducing household incomes by a greater margin than an equivalent increase in corporate taxes. It’s economic alchemy gone horribly wrong, transforming the potential for prosperity into a steaming pile of fool’s gold. One might wonder if anyone in the administration bothered to consult an actual economist before embarking on this ill-advised crusade.

The ever-pesky specter of economic policy uncertainty, that dreaded boogeyman of financial markets, is climbing to record highs, fueled by Trump’s erratic trade pronouncements and his general penchant for economic brinkmanship. One never quite knows what the next tweet will bring, what industry will be arbitrarily targeted, or what long-standing trade relationship will be summarily dismantled. Japan, among other economies, has already seen its GDP take a not-insignificant hit (around 0.9%) due to the global insecurity sparked by U.S. tariffs. Businesses, understandably hesitant to invest in such a volatile climate, are delaying hiring and capital projects. Households, faced with rising prices and the looming threat of economic recession, are postponing those big-ticket purchases they were so diligently saving up for. The result is a global domino effect, a messy and disheartening slowdown in what was once a reasonably synchronized period of economic growth, all thanks to one man’s penchant for protectionist pyrotechnics.

And of course, no trade war is complete without a healthy dose of retaliatory tariffs, those vengeful spirits that haunt the global marketplace, forever seeking to even the score. From Canada and Mexico to India and China, countries are responding to Trump’s tariff offensive with tariffs of their own, creating a tit-for-tat cycle of escalating duties and escalating tensions. The triggers for these skirmishes are often absurdly petty: higher duties on Chinese electronics, Canadian energy, Indian goods—the economic equivalent of playground squabbles escalating into full-blown gang wars. These moves erode trust, push national economies toward recession, and destabilize key sectors globally, transforming international trade into a high-stakes game of chicken with potentially catastrophic consequences for everyone involved.

The damage, naturally, isn’t confined to government spreadsheets and macroeconomic indicators. Industries across the spectrum, from carmakers struggling to source affordable steel to construction companies grappling with sky-high aluminum prices, are feeling the pinch of Trump’s policies. Consumers, of course, are the ultimate victims, paying more for everything from clothing and electronics to groceries and gasoline. U.S. steel and aluminum duties have inflated costs for manufacturers and builders, squeezing profit margins and forcing companies to either absorb the losses or pass them on to consumers, further fueling inflation and eroding purchasing power. Even global behemoths like Walmart, those masters of supply chain efficiency, have admitted to either absorbing or passing on these increased costs, signaling the pervasive and inescapable nature of the tariff burden.

The international economic bodies, those bastions of measured and cautious pronouncements, are now sounding the alarm with increasing urgency, warning of the trade war’s devastating toll on the global economy. The OECD, for instance, projects global GDP shrinking to a dismal 2.9% in 2025–26—down from a previously anemic 3.3%—citing trade uncertainty and tariff barriers as the primary culprits. The IMF, never one to be outdone in the doomsaying department, echoes this grim prognosis, projecting U.S. growth slashed to approximately 1.6% and warning that global recession risks have tripled under prolonged tariffs. It’s a symphony of economic pessimism, all conducted with gusto by Trump himself, a masterful performance of self-inflicted wounds on a global scale. One has to wonder if he truly grasps the magnitude of the damage he’s inflicting, or if he simply sees it as a necessary sacrifice in his quest to “Make America Great Again.”

Adding to the already considerable mess is the looming threat of inflation, ever ready to pounce at the slightest provocation. Tariffs, combined with the ever-present threat of escalating tensions in the Middle East, threaten to raise energy and consumer prices across the board, reversing hard-won inflation gains and forcing the Federal Reserve to delay much-anticipated interest rate cuts. This creates a precarious situation where households and businesses alike are squeezed from both ends, struggling to cope with rising costs and limited access to capital. The financial markets, while temporarily buoyed by fleeting moments of optimism, risk a catastrophic tumble if economic growth falters, transforming Wall Street into a high-stakes casino where the odds are stacked against everyone but the house. It’s a recipe for disaster, meticulously crafted and expertly executed by an administration seemingly indifferent to the consequences.

Unsurprisingly, Trump’s trade policies are forcing a dramatic realignment of global economic partnerships. Countries are scrambling to forge new alliances and abandon old loyalties in a desperate attempt to mitigate the damage and protect their own interests. India, for example, is emerging as a potential beneficiary of the trade war, as firms divert manufacturing away from China to more neutral hubs, capitalizing on the chaos and positioning itself as a rising economic power. While some U.S. allies, like Canada and Mexico, seek solace in regional partnerships, pivoting deeper into North American trade, many countries are forming their own regional blocs to insulate themselves from the economic shocks emanating from Washington, creating a fragmented and increasingly hostile global trading system. The long-term implications of these shifts are difficult to predict, but one thing is certain: the world is changing, and America’s position within it is becoming increasingly precarious.

Perhaps the most unsettling aspect of this entire debacle is the eerie echo it evokes of the Great Depression and the infamous Smoot–Hawley Tariff, widely blamed for collapsing global trade and exacerbating the economic crisis. The 2025 tariffs, in many cases, exceed the levels seen during that disastrous period, risking a repeat of international fragmentation as economies erect defensive trade blocs, shutting themselves off from the world and condemning themselves to economic stagnation. It’s as if history is trying to warn us, shouting from the rooftops about the dangers of protectionism, but the Trump administration, blinded by its own ideological fervor, simply refuses to listen. One has to wonder if they truly believe that “this time is different,” or if they’re simply willing to gamble with the global economy in pursuit of their own narrow political goals.

In conclusion, Trump’s trade offensive may provide a temporary boost to his domestic approval ratings, appealing to a misguided sense of economic nationalism, but it’s ultimately a pyrrhic victory, a triumph that comes at such a high cost that it’s barely worth celebrating. U.S. consumers, workers, and markets are paying a steep price for Trump’s protectionist zeal, enduring higher prices, reduced economic opportunities, and a diminished quality of life. Meanwhile, global growth is stalling, supply chains are fracturing, and strategic alliances are shifting, leaving America isolated and diminished on the world stage. America’s once far-reaching and admired economy may find itself more insulated, but it also finds itself more alone, a fortress besieged by its own self-inflicted wounds.

Ultimately, Trump’s trade war serves as a stark reminder of the dangers of economic nationalism and the importance of international cooperation. Tariffs, in theory, are supposed to build walls to protect domestic industries; in practice, they tend to wreck entire economies, both at home and abroad. The hope now is that the world can learn from this misguided experiment and steer a course back toward a more open, cooperative, and prosperous global trading system. But with Trump still wielding the tariff hammer, the future remains uncertain, and the threat of further economic disruption looms large.